Applying to university can be an exciting experience. You are imagining what classes you will take, how you will decorate your dorm, and picturing all the fun things you will do with your friends. But there’s one thing you may not be thinking about just yet; How you will budget for all of this.

Luckily, I have already been through this, so in this blog I will go over some options and examples on how to budget for university.

Fixed Expenses

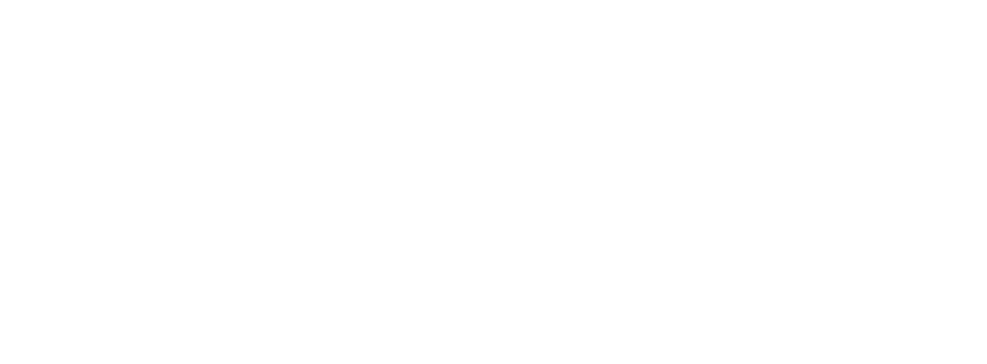

First, you will need to determine what your fixed expenses will be. Fixed expenses are expenses that don’t change month-to-month and can’t be eliminated or changed. Most of these expenses will be due at the begging of the academic year or the beginning of each semester, such as tuition, but you can also have fixed expenses each month, such as rent.

Example of fixed expenses:

Variable Expenses

Next, try to calculate your variable expenses. Variable expenses can change each month and look different for each person based on their lifestyle. Variable expenses have a range of categories and may occur either every month or only once in a while.

Example of Variable expenses:

Income

Income can be any form of funds you use to pay for your expenses. As a student, you have many options for income.

Scholarships/Awards

These are non-repayable amounts of money awarded to students based on a successful application, often based on academic achievement or involvement in the community. Scholarships and awards are often available through the university you are attending, but there are many available through other organizations as well.

TRU has many scholarships and awards specifically for students beginning their post-secondary studies called entrance scholarships and entrance awards.

For more information on entrance scholarships and awards check out our blog post Entrance Scholarships and Awards, or visit TRU’s website.

Loans

A loan is money that you borrow and needs to be repaid. You can apply for a loan through the government (provincial or federal), or through a private institution such as a bank. The benefit of a government student loan is no interest fees apply to these loans, and you may not have to start making repayments until you graduate.

Band Funding

Status First Nations post-secondary students can apply for funding through their local band to help pay for expenses such as tuition, books, travel support, and living allowances.

For more information on indigenous supports, you can make an appointment with a Qelmúcw (Indigenous) Future Student Advisor or visit the Indigenous Services Canada (ISC) webpage.

Part-Time Job

You may choose to work part-time to help pay for your expenses. You can apply for jobs off campus, or you can also work on campus. WorkStudy is a TRU funded financial assistance program running on the Kamloops and Williams Lake campuses which offers an opportunity for full-time Canadian students with financial need to work part-time in positions that accommodate their studies.

Family Support

Your family may be able to help pay for your studies as well. They may have savings set aside to help you pay for university, or they may be able to help with the occasional expense. Always ask your family before assuming any financial support.

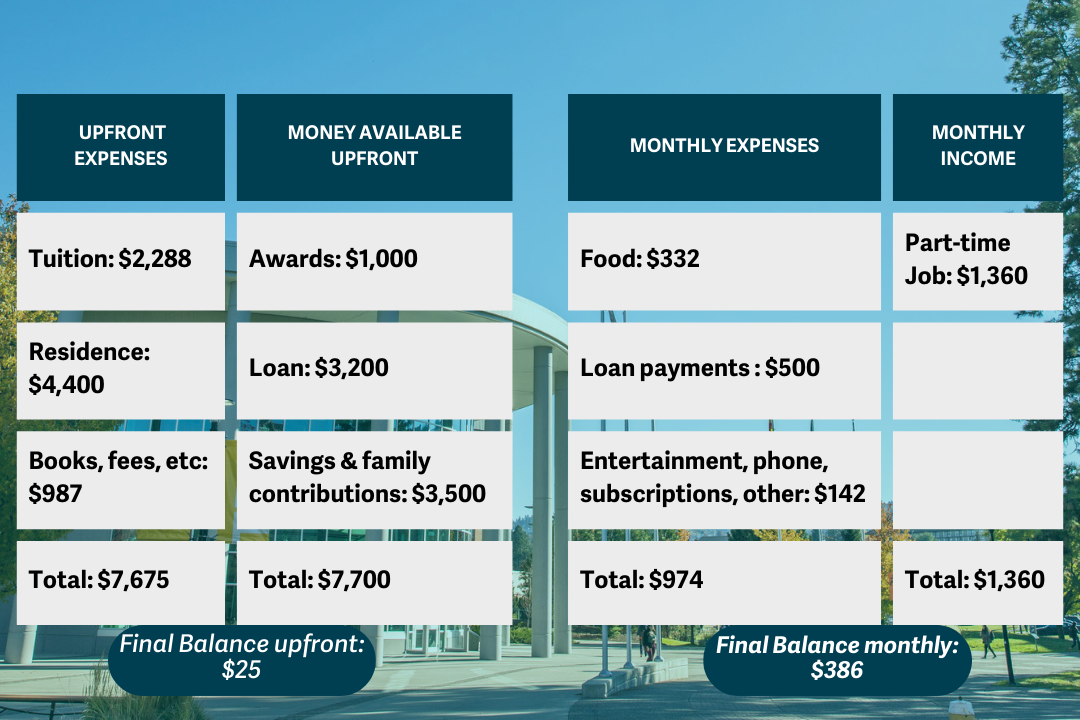

Example Budget

I’ve created an example of a first-year student’s expected upfront and ongoing expenses and payment methods. This example is of a first-semester domestic undergraduate student enrolled in 15 credits; actual expenses may vary.

Additional Resources

TRU Financial Advising: Financial Advising: Thompson Rivers University (tru.ca)

TRU Residences costs: On Campus Residences – Future Students | Thompson Rivers University (tru.ca)

TRU cost estimator: Cost Estimator – Future Students | Thompson Rivers University (tru.ca)

TRU – Funding your education: Funding Your Education – Future Students | Thompson Rivers University (tru.ca)

Student Recruitment Assistant Intern Jenny – Bachelor of Business Administration Graduate, “How to Budget for University- A Former Student’s Experience“, August 2, 2023.